We invited Chris from Tree of Prosperity and Brian from Forever Financial Freedom to share what they have learnt in investing at the 'Beginner’s Guide To Equities & REIT Investing' workshop. It was held at DBS NAV on 25th Jan 2018.

The audience were young and lively and reflected the millennials’ interest in investing and wealth building.

Beginners' Guide to Investing in Equities

What Readers Learnt From Brian

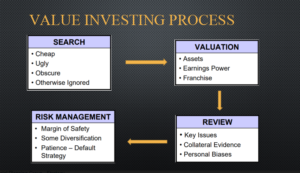

Brian broke down his slides into 3 main parts:

- Basic of Equities

- Risk Management

- Valuation Methodology

For the first part, he demonstrated why equities remains a solid asset class of choice for investors in the long run, especially when compared to bonds, cash, gold, etc.

He then explained about the risk of investing in equities. Like any other asset class, the risk of investing in equities can be broken down into unsystematic risks and systematic risks. He also explained the ways to mitigate these risks as optimally as possible.

Finally, he introduced different valuation methodologies that an investor could use to find out the intrinsic value of a company.

Besides the popular discounted cashflow (DCF) methodology, he also introduced the net net concept of valuing a company through their balance sheet.

Lastly, he contrasted the Earnings Power Value (EPV) Model with the DCF methodology. He also stressed that each methodology had their own merits.

Beginners' Guide to REITs Investing

What Readers Learnt From Chris

Chris’s talk was divided into five parts.

The first part discussed how Baby Boomers accumulated wealth via direct investments in real estate. There is a weakness to this approach as one would have to deal with problems typically faced by landlords.

The second part of the talk discusses how REITs work with an emphasis on how tax advantageous these instruments are.

The third and fourth parts of his talk touched on the advantages and disadvantageous of REITs investing. In particular, rising interest rates, falling rentals and changes in tax laws were flagged as the biggest risks that all REIT investors would need to watch out for.

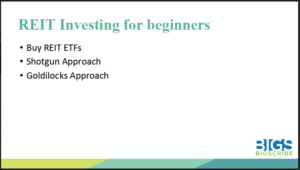

The last part of his talk introduces three possible ways for beginners to start REIT investing.

- The first strategy shared was to invest in REIT ETFs.

- The second strategy was to invest in equal proportions of every REITs available on SGX.

- The last strategy was to target a specific subset of REITs that produces yields of 6-8% p.a.

Question and Answers (Q&A)

One question posed to Chris was "how could a person be confident of retiring if REIT dividends tend to fluctuate over time which would create a lot of uncertainty for investors and potential retirees".

Chris replied that confidence comes from having a spending pattern way below the passive income stream.

As for Brian, there were some questions about his own portfolio holdings on which he elaborated on. There was also a question towards the end on the minimum amount to start investing and suitable platforms.

Brian replied that anyone could start investing with as little as $100 a month. He recommended the POSB Invest-Saver where the investor could regularly purchase units of the STI ETF and benefit from dollar cost averaging (DCA).

This event was held by BigScribe in partnership with NAV – Your Financial GPS

Targeted at novices in financial planning. NAV – Your Financial GPS is an initiative by DBS and POSB that aims to help customers navigate through life’s changes, uncertainties and opportunities.

NAV Hub is located in the central business district at Tanjong Pagar, and is the first of its kind to be set up by a bank in Singapore.

Attendees can enjoy free personalised financial planning sessions with the NAV crew, where they can learn more about their current financial health, as well as understanding their financial goals and how to achieve them. The sessions are free and by appointment only, with no-financial products being sold.

Sign up for a free session by clicking HERE!